ABSTRACT:

This study examines the influence of capital structure, measured by the debt-to-equity ratio (DER), and financial performance, measured by return on assets (ROA), on firm value, proxied by the price-to-earnings ratio (PER). It also investigates the moderating role of firm size, represented by market capitalization. The analysis uses panel data from financial companies listed on the Ho Chi Minh Stock Exchange (HOSE) and Hanoi Stock Exchange (HNX) over the period 2012–2022. The results reveal that ROA has a significant positive effect on firm value, whereas DER exerts a negative but statistically insignificant impact. Firm size does not moderate the relationship between either DER or ROA and firm value. Unlike previous studies, this research contributes a more nuanced perspective by integrating firm size as a moderating variable, thereby addressing a gap in the literature. However, the study is limited by its exclusive use of ROA as a performance metric and its omission of macroeconomic variables, suggesting directions for future research.

Keywords: capital structure, financial performance, firm value, firm size.

JEL Classification: G31

1. Introduction

Globalization, driven by advancements in technology, transportation, and science, has significantly influenced all sectors, including economics and trade (Do et al., 2024). As companies seek to grow, capital becomes essential yet managing it efficiently remains a major challenge. Financial management must attract investment and ensure optimal use of capital to enhance firm value and performance (Sukoco, 2023). Effective use of debt is particularly important, as it can help minimize risks and improve firm outcomes (La Rocca et al., 2011).

Capital structure and financial performance are two critical factors affecting firm success and value. According to Baker & Martin (2011), capital structure is the mix of debt and equity used to finance operations and growth. An inappropriate capital mix can increase costs and reduce competitiveness. While debt can lower taxes and raise stock prices, excessive debt increases risk. Therefore, firms must balance debt and equity wisely to protect long-term value (Hussein, 2020; Rasyid, 2015). DER is a key indicator used to assess capital structure effectiveness.

Financial performance, linked to profitability and operational efficiency, is equally vital for firm sustainability (Mouzas, 2006.; Markonah et al., 2020). Strong financial performance not only supports business continuity but also enhances firm value by attracting investor confidence and increasing market share.

This study explores the relationship between capital structure, financial performance, and firm value while considering firm size as a moderating factor. Unlike previous studies that focused only on direct relationships, this research adds depth by incorporating interaction effects in the context of Vietnam. The findings aim to provide practical insights to help firms improve financial management, enhance performance, and pursue sustainable growth.

2. Literature review

2.1. Capital structure

Capital structure refers to the mix of debt and equity used to finance a company's operations Birru (2016). According to Modigliani & Miller (1958, 1966) supported by studies such as Dabi et al. (2023) and Suratno & Roosna (2023), a higher debt ratio can positively impact firm value. Sukoco (2023) defines capital structure as funding sourced from long-term debt, preferred shares, and equity, with financial decisions aimed at maximizing shareholder wealth. In summary, capital structure represents the balance between externally sourced debt (short- and long-term) and internal equity, which plays a key role in shaping firm value (Astuti, 2018)

2.2. Financial performancce

Financial performance reflects how effectively a company manages its assets over a specific period, indicating its financial health and operational efficiency (Sukoco, 2023; Barauskaite & Streimikiene, 2021). It also influences dividend distribution and investor confidence, as strong performance often leads to higher share demand and increased firm value (Kanakriyah, 2020; Siegel, 2021). According to Christina & Robiyanto (2018), financial performance is a key measure of profitability, directly linked to firm value. Ismanto (2023) further confirms that the higher the profitability, the greater the firm's market valuation. In this study, financial performance is assessed using return on assets (ROA), representing the firm’s ability to generate profits from its assets.

2.3. Firm size

Firm size reflects the scale of a company, commonly measured by total assets, revenue, or stock value (Mule et al., 2015). Larger firms tend to have more resources, enabling more efficient operations and easier access to both internal and external funding (Kopanos & Puigjaner, 2019; Aras & Mutlu, 2018). This study measures firm size using the natural logarithm of total assets to reduce data variability while maintaining proportional accuracy (Murhadi & Wijaya, 2017).

2.4. Firm value

Firm value refers to a company's total market capitalization, including equity and net debt (Szutowski, 2017). It reflects shareholder wealth, as higher firm value typically corresponds to higher stock prices and asset gains (Felicia et al., 2022). Maximizing firm value is a core objective of companies, especially when issuing shares to the public (Lazonick & O’sullivan, 2000). The stock price represents investor perceptions and reflects asset management and performance. According to Scholes (1972), market value arises from transactions between buyers and sellers, serving as a proxy for a firm’s real asset value. Positive investment opportunities signal growth potential, thereby enhancing firm value (Faozi & Ghoniyah, 2019).

2.5. Hypotheses development

Firm size plays a role in shaping a company's capital structure and financial performance. Larger firms often have more stable structures and operate more efficiently. According to pecking order theory (Frank & Goyal, 2003; Xhaferi & Xhaferi, 2015) firms prefer internal financing, followed by debt, and least prefer issuing equity. This approach minimizes financing costs and reflects firm strength. Studies by Santoso et al. (2020) and Mulyadi (2022) also highlight that debt can offer tax advantages. Sanusi (2022) and Sukoco (2023) argue that higher debt, when used effectively, helps firms expand and signals strong future prospects to investors, thereby enhancing firm value.

H1: Capital Structure has a positive impact on Firm Value.

Agency theory (Jensen & Heckling, 1976) describes the firm as a contract between owners and managers, highlighting the separation of ownership and control. To align interests, firms must implement proper incentives and monitoring (Nazir & Afza, 2018).. From this perspective, financial performance measured by ROA is positively associated with firm value. Higher profitability enhances shareholder wealth and signals strong company performance. Empirical studies (Sapiri et al., 2022; Sukoco, 2023) confirm that strong financial performance significantly boosts firm value.

H2: Financial Performance has a positive impact on Firm Value.

According to trade-off theory, firms balance the benefits of debt (e.g., tax shields) against potential costs like financial distress and agency problems (Nidar et al., 2019). Firms with volatile earnings or intangible assets tend to use less debt, while those with higher taxes borrow more. Capital structure, combining debt and equity, must be optimized to balance risk and return. Larger firms often rely more on debt to fund growth and signal strength to investors, potentially enhancing firm value (Mudjijah, 2019). Research by Zahrani et al. (2023) suggests that firm size may moderate the effect of capital structure on firm value.

H3: Company Size moderates the impact of Capital Structure on Firm Value.

Financial performance reflects how well a company utilizes its resources, commonly measured by ROA. A high ROA signals strong growth potential. Large and growing firms tend to gain more public recognition, which can boost profits and increase stock prices, thereby enhancing firm value (Aprilyani et al., 2021). Thus, firm size may influence the extent to which financial performance impacts firm value.

H4: Company Size is a factor that moderates the impact of Financial Performance on Firm Value.

3. Methodology

Based on the review of previous studies, the author has proposed two research models as follows:

Model 1: The impact of capital structure and financial performance on firm value.

Y = α + β1DER + β2ROA + ε (1)

Model 2: The impact of capital structure and financial performance on firm value under the regulation of company size.

Y = α + β1DER + β2ROA + β3FIRMSIZE + β4DER*FIRMSIZE + β5ROA*FIRMSIZE + ε (2)

Table 1. Variable Definitions and Expected Signs

![]()

Source: Compiled by the author.

4. Data

The study focused on large-cap companies listed on HOSE and HNX that fully disclosed annual and financial reports from 2012 to 2022. From an initial pool of 200 firms, 124 met the selection criteria. After data screening, the final panel dataset included 1,288 observations over the 2012–2022 period.

5. Results and discussions

With the above research data, the author conducted data processing, descriptive statistics, data analysis and obtained the following results:

5.1. Descriptive statistics

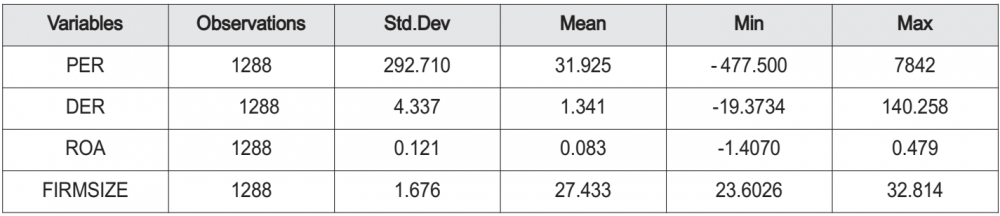

Table 2 summarizes the descriptive statistics of the main variables. PER shows high variation, with a mean of 31.93 and a maximum of 7,842, indicating considerable dispersion in firm valuations. DER ranges widely, from -19.37 to 140.26, with a mean of 1.34, reflecting diverse capital structures among firms. Return on assets (ROA), a proxy for financial performance, has a mean of 0.083 and ranges from -1.41 to 0.48, suggesting a wide gap in profitability. FIRMSIZE, measured as the logarithm of total assets, ranges from 23.60 to 32.81, with a mean of 27.43.

Table 2. Descriptive statistics

Source: Analysis results of the team from STATA software

5.2. The impact of capital structure and financial performance on firm value

To analyze the impact of DER and ROA on PER, the study applied panel regression models including Pooled OLS, FEM, and REM. Pooled OLS was selected as the preferred model due to its simplicity and consistency, despite its high p-value (Prob > F = 0.9464). FEM and REM models also showed no significant improvement, as confirmed by the Hausman test (Prob > chi2 = 0.9373).

Both DER and ROA coefficients were statistically insignificant (p > 0.1), and the R-squared value was very low (0.01%), indicating that most of the variation in firm value is driven by other factors. Diagnostic tests revealed heteroskedasticity (Breusch-Pagan test), no autocorrelation (Wooldridge test), and no multicollinearity (VIF < 2).

To address heteroskedasticity, the Feasible Generalized Least Squares (FGLS) method was applied. The FGLS results remained consistent with OLS findings: DER and ROA were still insignificant in explaining PER, and the model’s explanatory power was low (R² = 0.12%). These results suggest that in this context, neither capital structure nor financial performance significantly influence firm value.

Table 3 presents regression results on the impact of DER and ROA on PER. In Pooled OLS, FEM, and REM models, both variables are negative but not statistically significant. However, in the FGLS model, ROA shows a significant negative effect on firm value (p < 0.01), and DER becomes significant at the 10% level (p < 0.1). These results suggest that, after correcting for heteroskedasticity, higher debt and lower profitability are associated with lower firm value. The constant term remains positive and significant across all models.

Table 3. Regression Results on the Impact of Capital Structure and Financial Performance

on Firm Value (PER)

![]()

Source: Analysis results of the team from STATA software

5.3. The impact of Capital Structure and Financial Performance on Firm Value under the moderation of Firm Size

To assess whether firm size moderates the relationship between DER, ROA, and PER, the study employed Model 2 and tested three panel regression approaches: Pooled OLS, FEM, and REM.

Model selection was based on the F-test and Hausman test. Although FEM indicated statistical significance for firm size at the 10% level, its overall model fit was weaker. The Pooled OLS model had a high p-value (Prob > F = 0.8568), suggesting better consistency and suitability. The Hausman test also showed Prob > chi2 = 0.8708, confirming that REM was not preferable. Thus, Pooled OLS was chosen as the most reliable and appropriate model.

Regarding model performance, the R-squared value was very low (0.16%), indicating that most of the variation in firm value is explained by other factors beyond the included variables. Moreover, diagnostic tests revealed no autocorrelation (Wooldridge test) but did identify heteroskedasticity (Breusch-Pagan test).

To address this, the study applied the Feasible Generalized Least Squares (FGLS) method. The FGLS results were consistent with the initial findings from the OLS model: DER and ROA remained statistically insignificant, and firm size did not significantly moderate their effects on firm value.

These outcomes confirm that the selected Pooled OLS model, supported by robustness checks through FGLS, provides the most suitable estimation framework for analyzing the moderating role of firm size in this context.

Table 4 reports the regression results on the impact of DER and ROA on PER, with firm size as a moderating variable. Across all models (Pooled OLS, FEM, REM, FGLS), neither DER nor ROA shows a statistically significant effect on firm value. Similarly, the interaction terms (DER×FIRMSIZE and ROA×FIRMSIZE) are also insignificant, indicating that firm size does not moderate these relationships.

Only the FEM model reports a significant positive coefficient for firm size (p < 0.01), suggesting some isolated influence, but not consistent across models. R-squared values remain low (0.002–0.011), implying limited explanatory power. Overall, the results suggest that firm size does not significantly alter the impact of capital structure or financial performance on firm value in this context.

Table 4. Regression Results on The impact of Capital Structure and Financial Performance on Firm Value under the moderation of Firm Size

![]()

Source: Analysis results of the team from STATA software

Through the application of Pooled OLS, REM, FEM, and the FGLS regression method to address heteroskedasticity, this study produced several key findings:

First, the impact of capital structure on firm value: capital structure measured by the debt to equity ratio (DER) has a negative but statistically insignificant effect on firm value. This indicates that the presence of higher debt does not necessarily enhance firm valuation. Investors seem to focus less on leverage levels and more on how effectively the firm uses its capital to generate value. This result aligns with Sanusi (2022), Sukoco (2023), suggesting that excessive reliance on debt may not reflect positively unless well managed.

Second, the impact of financial performance on firm value: financial performance measured by return on assets (ROA) has a positive and significant effect on firm value. Firms that manage their assets efficiently and generate higher profits tend to be more attractive to investors, enhancing their market value. This reinforces the findings of Sapiri et al. (2022); (Sukoco, 2023), emphasizing that profitability is a key driver of valuation.

Third, the moderating effect of firm size on the relationship between capital structure and firm value was found to be insignificant. Whether a company is large or small, the influence of debt on value appears unaffected by size. This finding is consistent with Mudjijah (2019) and Rahmawati et al. (2021), and contrasts with Sukoco, (2023), who found a moderating role in a different context

Fourth, firm size also does not moderate the relationship between financial performance and firm value. Although larger firms may have more visibility or resources, the core determinant of firm value remains profitability. Other elements like brand strength or customer trust may explain variations better. Again, this finding is consistent with some prior studies but differs from others that identified firm size as a significant moderator. The results of this study differ from the studies of Mudjijah (2019) and Rahmawati et al. (2021) shows that company size can moderate the impact of financial performance on firm value, which is contrary to the study of (Sukoco, 2023).

These findings highlight that while capital structure and firm size are important considerations, profitability remains the strongest and most consistent predictor of firm value in the Vietnamese market.

6. Conclusions

This study examines the impact of capital structure, financial performance, and firm size on firm value using panel data from 124 manufacturing companies listed on HOSE and HNX during 2012–2022, totaling 1,288 observations. Regression techniques including OLS, FEM, REM, and FGLS were applied to ensure robustness.

The findings reveal three key insights. First, capital structure (measured by DER) does not have a significant effect on firm value. This suggests that the mere presence of debt is not sufficient to enhance firm value its effectiveness depends on how debt is utilized.

Second, financial performance (measured by ROA) shows a positive and statistically significant impact on firm value. Profitability emerges as a crucial factor for investors, as higher returns signal better management of resources and improve firm valuation.

Third, firm size does not moderate the relationship between either DER or ROA and firm value. This implies that larger scale alone does not enhance the effect of capital structure or financial performance. Investor perception is influenced more by profitability than by size.

Overall, the study contributes to corporate finance literature by analyzing how firm size interacts with key financial indicators. The results suggest that firms should focus on enhancing profitability and using capital efficiently, rather than increasing debt or scaling up without strategic alignment.

Future research may expand on these findings by incorporating macroeconomic variables or exploring different measures of firm value and financial performance to gain a more comprehensive understanding of value drivers in emerging markets like Vietnam

REFERENCES:

Aprilyani, I., Widyarti, M. T. H., & Hamida, N. (2021). The effect of erm, firm size, leverage, profitability and dividend policy on firm value (evidence from food & beverage sub sector companies listed in IDX 2015-2019). Jurnal Aktual Akuntansi Keuangan Bisnis Terapan (AKUNBISNIS), 4(1), 65-75.

Aras, G., & Mutlu Yildirim, F. (2018). The impact of corporate finance decisions on market value in emerging markets. International Journal of Productivity and Performance Management, 67(9), 1959-1976.

Astuti, E. (2018). Determinant capital structure of banking company in Indonesia. Kinerja, 22(1), 69-78.

Baker, H. K., & Martin, G. S. (2011). Capital structure and corporate financing decisions: theory, evidence, and practice. John Wiley & Sons.

Barauskaite, G., & Streimikiene, D. (2021). Corporate social responsibility and financial performance of companies: The puzzle of concepts, definitions and assessment methods. Corporate Social Responsibility and Environmental Management, 28(1), 278-287.

Birru, M. W. (2016). The impact of capital structure on financial performance of commercial banks in Ethiopia. Global Journal of Management and Business Research, 16(8), 44-52.

Christina, O., & Robiyanto, R. (2018). The Effect of financial performance and firm size on stock prices of manufacturing company in 2013-2016.

Dabi, R. S. K., Nugraha, Disman, & Sari, M. (2023). Capital structure, financial performance and sustainability of Microfinance Institutions (MFIs) in Ghana. Cogent Economics and Finance, 11(2).

Faozi, I., & Ghoniyah, N. (2019). Model of Corporate Value Improvement Through Investment Opportunity in Manufacturing Company Sector. International Research Journal of Business Studies, 12(2), 185-196.

Felicia, Y. R. E., Simorangkir, E. N., & Ginting, R. R. (2022). Analysis of the Effect of Profitability, Company Size and Growth Opportunity toward Firm Value with Capital Structure as Intervening Variable in Consumer Goods Companies Listed on Indonesia Stock Exchange period 2018-2020. Journal of Economics, Finance and Management Studies, 5, 335-345.

Frank, M. Z., & Goyal, V. K. (2003). Testing the pecking order theory of capital structure. Journal of Financial Economics, 67(2), 217-248.

Hussein, A. (2020). The influence of capital structure on company performance: Evidence from Egypt. Corporate Ownership and Control, 18(1), 8-21.

Ismanto, J. (2023). The Effect Of Company Size, Funding Decisions, And Financial Performance On Firm Value. Kunuz: Journal of Islamic Banking and Finance, 3(1), 37-49.

Jensen, M. C., & Heckling, W. H. (1976). Theory of the fitm: Managerial behavh agmq costs and ownership structure. Journal of Financial Ecotxxnics.

Kanakriyah, R. (2020). Dividend policy and companies’ financial performance. The Journal of Asian Finance, Economics and Business, 7(10), 531-541.

Kopanos, G. M., & Puigjaner, L. (2019). Solving large-scale production scheduling and planning in the process industries. Springer.

La Rocca, M., La Rocca, T., & Cariola, A. (2011). Capital structure decisions during a firm’s life cycle. Small Business Economics, 37, 107-130.

Lazonick, W., & O’sullivan, M. (2000). Maximizing shareholder value: a new ideology for corporate governance. Economy and Society, 29(1), 13-35.

Markonah, M., Salim, A., & Franciska, J. (2020). Effect of profitability, leverage, and liquidity to the firm value. Dinasti International Journal of Economics, Finance & Accounting, 1(1), 83-94.

Miller, M. H., & Modigliani, F. (1966). Some estimates of the cost of capital to the electric utility industry, 1954-57. The American Economic Review, 56(3), 333-391.

Modigliani, F., & Miller, M. H. (1958). The cost of capital, corporation finance and the theory of investment. The American Economic Review, 48(3), 261-297.

Mouzas, S. (2006). Efficiency versus effectiveness in business networks. Journal of Business Research, 59(10-11), 1124-1132.

Mudjijah, S. (2019). Analysis of the Influence of Asset Structure and Sales Growth on Capital Structure and its Impact on Corporate Profitability. Proceedings of the 1st Workshop on Multidisciplinary and Its Applications Part 1, WMA-01 2018, 19-20 January 2018, Aceh, Indonesia.

Mule, K. R., Mukras, M. S., & Nzioka, O. M. (2015). Corporate size, profitability and market value: An econometric panel analysis of listed firms in Kenya.

Mulyadi, H. D. (2022). Determinants of Financial Performance and Its Impact on Firm Value. Accounting and Finance Studies, 2(1), 77-102.

Murhadi, W. R., & Wijaya, L. I. (2017). The Effect Of Profitability, Tangibility, Size, Growth And Liquidity To Leverage Of Business Entities Listed In Indonesia Stock Exchange On Period 2011-2015.

Nazir, M. S., & Afza, T. (2018). Does managerial behavior of managing earnings mitigate the relationship between corporate governance and firm value? Evidence from an emerging market. Future Business Journal, 4(1), 139-156.

Nidar, S. R., Masyita, D., & Anwar, M. (2019). Analysis of Determinant Factors towards Dividend at Manufacturing Companies Listed in Indonesia Stock Exchange. Academy of Accounting and Financial Studies Journal, 23(2), 1-10.

Rahmawati, V. D., Darmawan, A., Setyarini, F., & Bagis, F. (2021). Profitability, Capital Structure, and Dividend Policy on Firm Value Using Company Size as A Moderating Variable (In the Consumer Goods Industry Sector Companies listed on the Indonesia Stock Exchange (IDX) during 2015-2019 Periods). International Journal of Economics, Business, and Accounting Research (IJEBAR), 5(1), 282-292.

Rasyid, A. (2015). Effects of ownership structure, capital structure, profitability and company’s growth towards firm value. International Journal of Business and Management Invention, 4(4), 25-31.

Santoso, H., Lako, A., & Rustam, M. (2020). Relationship of Asset Structure, Capital Structure, Asset Productivity, Operating Activities and Their Impact on the Value of Manufacturing Companies Listed on the Indonesia Stock Exchange. International Journal of Multicultural and Multireligious Understanding, 7(8), 358-370.

Sanusi, F. (2022). Capital Structure, Profitability, and Firm Value: Does Firm’s Dividend Policy Matter? Evidence from Telecommunication Industry. Proceedings of the International Colloquium on Business and Economics (ICBE 2022), 666, 87-97.

Sapiri, M., Hamzah, F. F., Putra, A. H. P. K., & Hadi, A. (2022). The Effect of Financial Performance on Firm Value with Financial Distress as an Intervening Variable. International Journal Of Artificial Intelegence Research, 6(1).

Scholes, M. S. (1972). The market for securities: Substitution versus price pressure and the effects of information on share prices. The Journal of Business, 45(2), 179-211.

Siegel, J. J. (2021). Stocks for the long run: The definitive guide to financial market returns & long-term investment strategies. McGraw-Hill Education.

Sukoco, E. (2023). Company Size as a lever between Capital Structure and Financial Performance on Firm Value. 16(2), 152-165.

Suratno, S., & Roosna, E. (2023). Intellectual capital and company size of state-owned company (BUMN) and its impact on company performance. ADPEBI International Journal of Business and Social Science, 3(1), 27-41.

Szutowski, D. (2017). Innovation and market value. The case of tourism enterprises. Helion.

Xhaferi, S., & Xhaferi, B. (2015). Alternative theories of capital structure. European Scientific Journal, 11(7), 327-343.

Zahrani, K., Mappadang, A., & Mappadang, J. L. (2023). The Effect of Capital Structure, Profitability and Audit Quality on Company Value with Company Size as a Moderation Variable. International Journal of Asian Business and Management, 2(6), 1039-1060.

TÁC ĐỘNG CỦA CẤU TRÚC VỐN VÀ HIỆU QUẢ TÀI CHÍNH

ĐẾN GIÁ TRỊ DOANH NGHIỆP:

VAI TRÒ ĐIỀU TIẾT CỦA QUY MÔ DOANH NGHIỆP

• NGUYỄN THỊ THANH HƯƠNG1

• LÊ NGỌC YẾN1

• DƯƠNG THỊ THANH THẢO1

• ĐÀM THỊ THANH NGÂN1

1Khoa Kế toán, Trường Đại học Tôn Đức Thắng, TP. Hồ Chí Minh, Việt Nam

TÓM TẮT:

Nghiên cứu này phân tích tác động của cấu trúc vốn, được đo bằng tỷ lệ nợ trên vốn chủ sở hữu (DER), và hiệu quả tài chính, được đo bằng tỷ suất lợi nhuận trên tài sản (ROA), đến giá trị doanh nghiệp, được đại diện bởi hệ số giá trên lợi nhuận (PER). Đồng thời, nghiên cứu cũng xem xét vai trò điều tiết của quy mô doanh nghiệp, được đo bằng giá trị vốn hóa thị trường. Dữ liệu bảng được thu thập từ các công ty tài chính niêm yết trên Sở Giao dịch Chứng khoán TP.Hồ Chí Minh (HoSE) và Sở Giao dịch Chứng khoán Hà Nội (HNX) trong giai đoạn 2012 - 2022. Kết quả cho thấy ROA có tác động tích cực và có ý nghĩa thống kê đến giá trị doanh nghiệp, trong khi DER có ảnh hưởng tiêu cực nhưng không đáng kể về mặt thống kê. Quy mô doanh nghiệp không có vai trò điều tiết mối quan hệ giữa DER hoặc ROA với giá trị doanh nghiệp. Khác với các nghiên cứu trước đây, nghiên cứu này mang lại góc nhìn sâu hơn khi tích hợp biến điều tiết là quy mô doanh nghiệp, từ đó góp phần lấp đầy khoảng trống trong tài liệu nghiên cứu hiện có. Tuy nhiên, nghiên cứu còn hạn chế khi chỉ sử dụng ROA làm thước đo hiệu quả tài chính và chưa xem xét các biến vĩ mô, mở ra hướng nghiên cứu tiếp theo trong tương lai.

Từ khoá: cấu trúc vốn, hiệu quả tài chính, giá trị doanh nghiệp, quy mô công ty.

[Tạp chí Công Thương - Các kết quả nghiên cứu khoa học và ứng dụng công nghệ số 18 tháng 6 năm 2025]