Abstract:

This study examines the influence of key macroeconomic factors: GDP growth, foreign direct investment, interest rates, and inflation, on the development of the circular economy, measured through green GDP. A comparative analysis is conducted between Germany, a developed economy leading in eco-innovation, and China, a rapidly growing economy facing substantial environmental pressures. Using statistical analysis of data from 2009 to 2019, the findings indicate that GDP growth has a significant and positive effect on Green GDP growth in both countries, suggesting that economic expansion can provide an important foundation for sustainable circular economy activities. In contrast, foreign investment, interest rates, and inflation do not show a statistically significant impact on Green GDP over the study period. These results underscore the central role of overall economic growth in supporting the circular economy development, while also highlighting the complexity of interactions between economic performance and environmental outcomes. The study contributes to the literature by offering cross-country evidence on macroeconomic determinants of the circular economy and provides a basis for deeper exploration of long-term dynamics in different institutional and developmental contexts.

Keywords: circular economy, green GDP, macroeconomic factors, economic growth, GDP growth.

1. Introduction

The urgency of climate change, biodiversity loss, and resource scarcity has brought the circular economy (CE) to the center of sustainability debates. CE promotes resource efficiency, closed-loop production, and regenerative design, as opposed to the traditional linear “take-make-dispose” model. Although CE is widely discussed in business and microeconomic contexts, its macroeconomic drivers remain underexplored. National growth indicators such as Gross Domestic Product (GDP), inflation, and trade balances shape the drivers and constraints for the transition to CE, but conventional GDP fails to capture the ecological costs of production. Hence, Green GDP, which subtracts environmental degradation and resource depletion from conventional GDP, was created to provide a more accurate measure of sustainable economic performance (Stjepanović et al., 2022).

This paper aims to explore the impact of macroeconomic factors on the Circular Economy through GDP, Green GDP, FDI Inflow, Interest rate and Inflation (CPI) of Germany and China as the two economies have contrasting development trajectories.

2. Literature review

2.1. The correlation between Schumpeter’s Creative Destruction theory and the circular economy

The paper builds on Schumpeter’s (1942) theory of creative destruction, in which economic growth thrives on cycles of innovation, wiping out old industries and giving birth to new ones. He outlined three main stages: invention sparks new ideas from science, not yet ready for the market; innovation turns them into viable products as entrepreneurs risk everything to drive change and expansion; and diffusion of technology as competitors copy it, increasing productivity while eliminating outdated methods. This loop drives continuous progress. Moving towards a circular economy (CE), Schumpeter’s framework explains how ecological innovations such as renewable energy, industrial symbiosis, circular design, and advanced recycling replace wasteful and polluting systems with sustainable ones. CE relies heavily on “sustaining” innovations for better efficiency and recycling, but disruptive changes, such as ownership-as-a-service models, are reshaping markets and competition. Overall, CE represents creative destruction, shaped by sectors, policies, and institutions.

2.2. Macroeconomic factors affect circular economy measurement

Macroeconomic factors such as GDP growth, FDI, interest rates and inflation play an important role in measuring the progress of the Circular Economy (CE), often through indicators such as conventional GDP and Green GDP. Conventional GDP tracks economic growth but ignores environmental harms such as biodiversity loss and emissions (He et al., 2020). Green GDP overcomes this by deducting those costs, providing a more realistic picture of sustainable growth, in line with CE’s focus on resource efficiency and regeneration (Chi et al., 2010; D’Amato et al., 2017). FDI brings technology transfer that promotes innovation in the green economy sector (Borensztein et al., 1998), while inflation shapes outcomes as moderate levels promotes spending, but high interest rates increase costs and discourage investment (Halim et al., 2017).

2.3. Research gap

Although the circular economy (CE) is a key sustainability model, a significant research gap remains most green economy studies focus on firm- or sector-level eco-innovations, ignoring broader macroeconomic drivers such as GDP growth and inflation (Bocken et al., 2014; Cainelli et al., 2020). Green GDP holds promise for monitoring sustainability (Chi et al., 2010; Stjepanović et al., 2022) but rarely links general economic forces to the green economy in a cross-country context.

This study fills that gap by examining how GDP growth, inflation, green GDP, FDI, and interest rates drive green economies in Germany and China, two economies that are taking different paths, combining macroeconomic theory with sustainability to guide smarter policies.

2.4. Germany and China comparative studies

Germany and China were compared because of offering contrasting cases. Germany is a developed eco-innovation leader blending industry and sustainability; and China is the world's top emerging economy with rapid GDP growth but heavy ecological costs. Hence, comparing their Green GDP reveals Circular Economy dynamics across diverse contexts.

3. Research methodology

3.1 Research hypothesis

Main goal of this paper was to explore the impact of macroeconomic on the Circular Economy growth, so the hypotheses are proposed as follows:

H1: GDP growth has a positive and significant effect on Green GDP growth.

H2: FDI Inflow has a positive and significant effect on Green GDP growth.

H3: Interest rate has a negative and significant effect on Green GDP growth.

H4: Inflation has a negative and significant effect on Green GDP growth.

3.2. Research data

3.2.1. Data source

Data for Germany and China were taken from authoritative source as World Bank. Green GDP figures, collected by Stjepanović et al. (2022), cover 1970 to 2019. Due to complexities in environmental cost estimation and data availability challenges (NGFS, 2023), the analysis focused on the 10-year period from 2009 to 2019 only.

3.2.2. Research variables

The research variables were stimulated in Table 1. The research variables included Green GDP as the dependent variable, and other macroeconomic factors were the independent variables.

Table 1. Variable table

3.3 Analytical methods and econometric model

Based on the high reputation data source, to explore the impact of macroeconomic on Circular Economy (CE) growth, the correlation and regression analysis were conducted to assess the research hypothesis. The study employs an econometric model as follows:

In this model, “i” represents a country, and β0 is the baseline Green GDP growth rate when all other factors are equal to 0. The annual percentage growth rate of real GDP of country i is expected to positively impact Green GDP growth (β1 > 0). Foreign direct investment inflows, measured as a percentage of GDP, also positively impact Green GDP growth (β2 > 0). Conversely, higher interest rates (β3 < 0) and increased inflation rates (β4 < 0) are expected to negatively impact Green GDP growth. The model includes an error term to capture unexplained variation .

4. Results

4.1 Correlation analysis

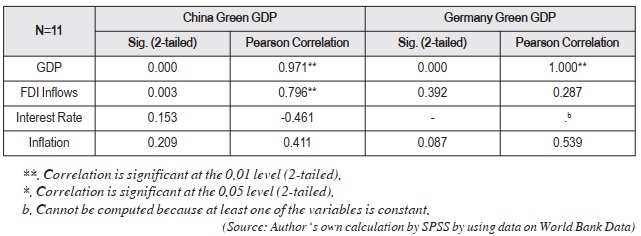

Before conducting the regression to evaluate the research hypothesis, correlation analysis was implemented for both cases including China and Germany as Table 2 to check to understand the interaction between dependent variables (Green GDP) and independent variables (GDP, FDI Inflows, Intertest Rate, and Inflation).

Table 2. Correlation analysis of Green GDP and macroeconomic factors (2009-2019)

According to the result of correlation analysis, GDP has significant and strong correlation with Green GDP. It was shown by Sig. (2 tailed) < 0.05 and Person Correlation > 0.04 with two * for both China and Germany cases. Besides, FDI Inflows has significant and strong correlation with Green GDP with Sig. (2 tailed) < 0.05 and Person Correlation > 0.04 with two * for China case only. For Germany, FDI Inflows was found uncorrelated with Green GDP with Sig. (2 tailed) > 0.05. Also, Interest Rate of China case was clarified as uncorrelated with Green GDP with Sig. (2 tailed) > 0.05, but in Germany, this variable was eliminated because Germany Interest Rate equals to 0 for all years including selected duration 2009 to 2019. Inflation was clarified as uncorrelated with Green GDP with Sig. (2 tailed) > 0.05.

From result of correlation analysis as below, the regression analysis was conducted with independent variables such as GDP and FDI Inflows. GDP was implemented on regression analysis of both China and Germany cases. FDI Inflows was conducted on regression analysis of China case only.

4.2 Testing hypothesis through regression and correlation analysis

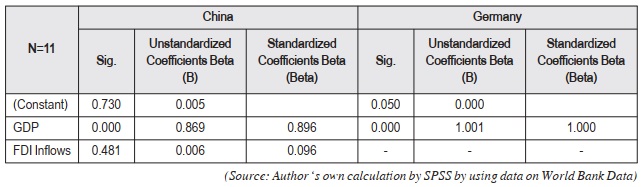

The results of regression analysis are shown in Table 3. Hypothesis testing was interpreted as details below:

Table 3. Regression analysis - coefficients

Hypothesis 1 (H1) proposed that GDP growth positively and significantly boosts Green GDP growth. Results confirmed this for both China and Germany, with significance levels under 0.05, positive coefficients (B=0.869 for China, B=1.001 for Germany), and Beta values (0.896 and 1.000), so H1 was accepted.

Also, hypothesis 2 (H2) claimed FDI inflows do the same positively. But correlation analysis found no link, and China's regression showed insignificance (Sig >0.05), rejecting H2.

Hypothesis 3 (H3) expected interest rates to harm Green GDP negatively. No significant correlation in China (Sig >0.05), and Germany's rates stayed at zero (2009–2019), so H3 is rejected.

Besides, hypothesis 4 (H4) suggested inflation negatively impacts it significantly, but correlations were insignificant (Sig >0.05), rejecting H4. Overall, only GDP growth reliably drives Green GDP growth.

5. Discussion and conclusion

This study investigates how key macroeconomic factors as GDP growth, Foreign Direct Investment (FDI) inflow, interest rate, and inflation, affect to Circular Economy (CE) growth, measured by Green GDP growth, in Germany and China from 2009 to 2019. Using correlation and regression analyses, the study addresses gaps regarding macroeconomic drivers of CE development.

The analysis strongly supports Hypothesis 1 (H1), showing that GDP growth has a positive and statistically significant effect on Green GDP growth in both economies. This indicates that the shift toward a circular economy, reflected in sustainability-adjusted growth, is closely linked to traditional economic expansion. Increased GDP may enhance government and corporate capacities to invest in eco-innovations and resource-efficient technologies, echoing the "sustaining innovation" within Schumpeter’s creative destruction framework. However, Hypotheses 2, 3, and 4 - concerning the effects of FDI inflows, interest rates, and inflation - lack supporting evidence. For China, FDI inflows, interest rates, and inflation showed no significant relationship with Green GDP. In Germany, interest rates remained constant at zero and were excluded, and FDI inflows were not significantly correlated with Green GDP.

These findings suggest that during the study period, investment and price stability factors did not strongly influence sustainable growth in these nations, possibly due to limited sample size, timeframe, or overriding industrial policies. Ultimately, this comparative study emphasizes the central role of traditional economic growth in fostering sustainable development across different contexts. Although Green GDP offers a more precise sustainability metric than conventional GDP, its growth is largely driven by overall economic expansion. Future research should explore longer data series to assess the effects of financial and policy variables on the circular economy’s evolution more comprehensively.

References:

Bocken, N. M. P., Short, S. W., Rana, P., & Evans, S. (2014). A literature and practice review to develop sustainable business model archetypes. Journal of Cleaner Production, 65, 42–56. Available at https://doi.org/10.1016/j.jclepro.2013.11.039

Borensztein, E., De Gregorio, J., & Lee, J.-W. (1998). How does foreign direct investment affect economic growth? Journal of International Economics, 45(1), 115–135. Available at https://doi.org/10.1016/S0022-1996(97)00033-0

Cainelli, G., D’Amato, A., & Mazzanti, M. (2020). Resource-efficient eco-innovations for a circular economy: Evidence from EU firms. Research Policy, 49(1), 103827. Available at https://doi.org/10.1016/j.respol.2019.103827

Chi, Ying F.; Rauch, Jason N. (2010). The Plight of Green GDP in China. Consilience: The Journal of Sustainable Development (3), 102–116. Available at https://doi.org/10.7916/consilience.v0i3.4498

D’Amato, D., Droste, N., Allen, B., Kettunen, M., Lähtinen, K., Korhonen, J., Leskinen, P., Matthies, B. D., & Toppinen, A. (2017). Green, circular, bio economy: A comparative analysis of sustainability avenues. Journal of Cleaner Production, 168, 716–734. Available at https://doi.org/10.1016/j.jclepro.2017.09.053

Halim, A., Aflituniah, A., & Safitri, H. (2017). Inflation and economic growth: A case of Southeast Asia. Economic Journal of Emerging Markets, 9(1), 22–31. Available at https://doi.org/10.20885/ejem.vol9.iss1.art3

He, G., Xie, Y., & Zhang, B. (2020). Expressways, GDP, and the environment: The case of China. Journal of Development Economics, 145, 102485. Available at https://doi.org/10.1016/j.jdeveco.2020.102485

Network for Greening the Financial System (NGFS). (2023). Bridging data gaps: A report on data needs and availability for macroeconomic and financial stability analysis. Paris: NGFS Secretariat, Banque de France. Available at https://www.ngfs.net/sites/default/files/medias/documents/final_report_on_bridging_data_gaps.pdf

Stjepanović, S., Tomic, D., & Skare, M. (2022). A new database on Green GDP, 1970–2019: A framework for assessing the green economy. Oeconomia Copernicana, 13(4), 829–864. Available at https://doi.org/10.24136/oc.2022.027

Wikipedia (unknow year), Green gross domestic product. Available at https://en.wikipedia.org/wiki/Green_gross_domestic_product#cite_note-:0-1

World Bank data. Available at https://data.worldbank.org/indicator/NY.GDP.MKTP.CD

TÁC ĐỘNG CỦA CÁC YẾU TỐ KINH TẾ VĨ MÔ ĐẾN SỰ PHÁT TRIỂN KINH TẾ TUẦN HOÀN: SO SÁNH GIỮA ĐỨC VÀ TRUNG QUỐC

Tạ Thụy Hồng Vân

Giảng viên cơ hữu, Khoa Quản trị Kinh doanh, Trường Đại học Ngoại ngữ - Tin học TP.Hồ Chí Minh

Tóm tắt:

Nghiên cứu này xem xét tác động của các yếu tố kinh tế vĩ mô chủ chốt, bao gồm tăng trưởng GDP, đầu tư trực tiếp nước ngoài (FDI), lãi suất và lạm phát, đối với sự phát triển của kinh tế tuần hoàn, được đo lường thông qua chỉ tiêu GDP xanh (Green GDP). Phân tích so sánh được thực hiện giữa Đức, một nền kinh tế phát triển đi đầu trong đổi mới sinh thái, và Trung Quốc, một nền kinh tế tăng trưởng nhanh đang phải đối mặt với áp lực môi trường lớn. Dựa trên phân tích thống kê dữ liệu giai đoạn 2009 - 2019, kết quả cho thấy tăng trưởng GDP có tác động tích cực và có ý nghĩa thống kê đến tăng trưởng GDP xanh ở cả hai quốc gia, hàm ý rằng mở rộng kinh tế có thể tạo nền tảng quan trọng cho các hoạt động kinh tế tuần hoàn bền vững. Ngược lại, FDI, lãi suất và lạm phát không cho thấy tác động có ý nghĩa thống kê đối với GDP xanh trong giai đoạn nghiên cứu. Những phát hiện này nhấn mạnh vai trò trung tâm của tăng trưởng kinh tế tổng thể trong việc thúc đẩy phát triển kinh tế tuần hoàn, đồng thời phản ánh tính phức tạp trong mối tương tác giữa hiệu quả kinh tế và kết quả môi trường. Nghiên cứu đóng góp bằng chứng so sánh liên quốc gia về các yếu tố vĩ mô chi phối kinh tế tuần hoàn, đồng thời tạo cơ sở cho các nghiên cứu sâu hơn về động lực dài hạn trong những bối cảnh thể chế và trình độ phát triển khác nhau.

Từ khoá: kinh tế tuần hoàn, GDP xanh, các yếu tố kinh tế vĩ mô, tăng trưởng kinh tế, tăng trưởng GDP.

[Tạp chí Công Thương - Các kết quả nghiên cứu khoa học và ứng dụng công nghệ, Số 32 năm 2025]